Short and Long‐Run Energy Demand Models

There is a long history of economists studying the demand for energy, especially the residential

demand for energy. As the literature developed, there was a realization that, as a household commodity,

energy has several economically distinctive features which make its demand different from the household’s

demand for most other commodities. One distinctive feature is that households do not have a demand for

electricity per se in the way that they have a demand for eggs or butter or bread. What households demand

is lighting, or heating, or the ability to operate useful devices such as a computer, or a refrigerator. Thus,

electricity is demanded as the means to desired end uses (heating, lighting, etc.); it is those end uses that

provide utility to the household. Second, with many end uses the demand for energy is mediated through the

type and number of energy‐using systems or appliances used in the home. In terms of a household production

6

function, energy is a variable input but there is also a capital input in the form of appliances – boilers,

refrigerators, lighting fixtures, etc. Changes in the amount of energy consumed for a given end‐use can occur

through a change in the rate of utilization of the existing capital stock and/or a change in the size and

composition of the capital stock. Examples of the latter include switching to an energy‐efficient refrigerator,

switching from incandescent to LED lighting, etc. There is some evidence that, in many cases, changes in the

capital stock can lead to a larger change in energy usage than changes in the stock’s rate of utilization.

Because of its durability, the capital stock is likely to be changed infrequently: thus, data covering a short‐span

of time are less likely to reveal information regarding changes in the size or composition of the capital stock.

Another important feature of energy demand relates to the choice of fuel source. Appliances are typically tied

to a particular fuel source – electricity, natural gas, oil, etc. Therefore, major changes in the particular fuels

used by a household are typically accompanied by changes in the appliance stock: switching from using

electricity to natural gas as the fuel source for space heating typically requires modification or replacement of

the heating device. This makes changing the fuel source costly – beyond the fuel price itself there is the capital

cost associated with modifying or replacing the fuel‐using appliance. It also makes the changing of fuel source

a relative infrequent event.

The common approach to analyzing fuel substitution by household employs a discrete‐continuous choice

model like the Dubin‐McFadden‐Hanemann (DMH) model, which combines the household’s choice of fuel

source (a discrete choice) together with its choice of how much fuel to use (the continuous choice) in a single

utility‐maximizing decision.1 For something like space heating, however, this characterization of the

household’s decision making probably comports poorly with the actual circumstances of choice because the

two choices occur on very different time frames. The continuous choice can be varied frequently (e.g., hourly

or daily) while the discrete choice arises only occasionally at best. The DMH model should ideally be used for

households who actually are installing new equipment because that is when the opportunity for a fuel choice

occurs. At other times, the household is restricted with regard to its choice of fuel by the particular equipment

that it owns.

Heating is the largest end‐use of energy in the home in Europe, and this holds true for Spain.2 When is a

household likely to install new heating equipment, apart from when the home is built? In theory, a homeowner

could install new heating equipment at any time. The homeowner could wake up any morning and decide that

he is tired of the existing heating system and wants to replace it. In practice, however, this is rather unlikely

to occur randomly in time. For one thing, heating equipment is expensive, and replacing a perfectly good

system which is still working adequately will seem a waste of money to most people, except for those who are

exceptionally rich or exceptionally whimsical. Moreover, many people are creatures of habit and postpone

changes in their living circumstances for as long as possible. There are two occasions when investment in a

new heating system for an existing home is most likely to occur: when the existing system breaks down, or

when people are moving into a new home and choose to renovate it before settling in. Those are likely to be

the occasions when there is a discrete choice (which fuel source to use) as well as a continuous choice (how

much fuel to use) that are determined simultaneously in a DMH model framework. That is the hypothesis we

attempt to investigate in this paper.

The presentation will be organized as follows: in section 2 we revise the main data source used and compare

it with aggregate information. In section 3 we review the theoretical demand models behind discrete choices

of this type, i.e., models in the DMH framework, and we discuss identification issues and estimation

implications. In section 4 we analyze the sample of households investing in capital with the purposes of

changing the source of heating and we also try to explain the determinants of investing. Section 4 is devoted

to analyze fuel choices for the sample in the market (those investing) and compare it with the results for the

whole sample. We adjust in section 6 the conditional demand and estimate the price elasticities. Section 7

concludes.

-

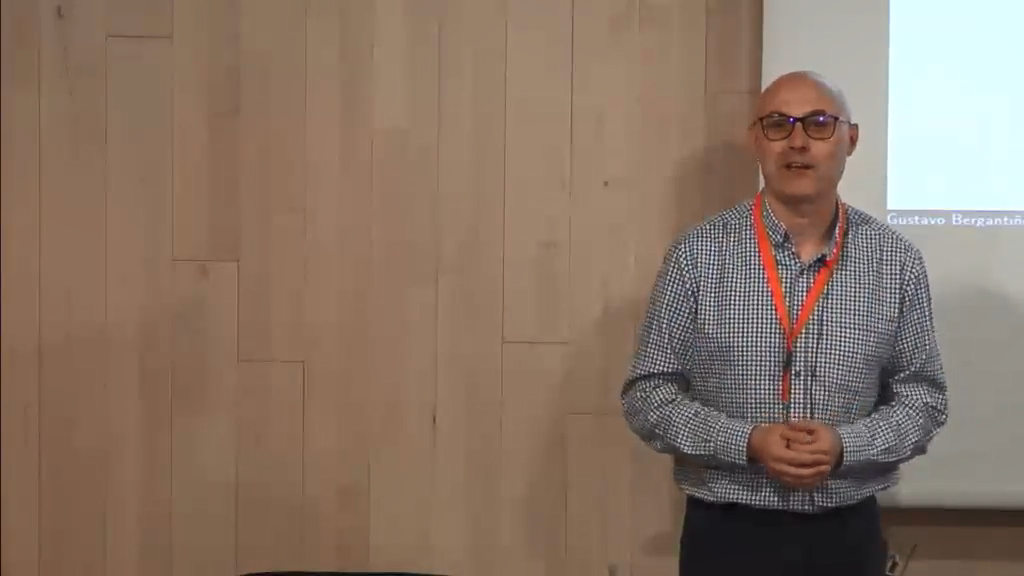

José María Labeaga Azcona catedrático de Análisis Económico, UNED